SANDISK CORP (SNDK)·Q2 2026 Earnings Summary

Sandisk Crushes Q2 with $6.20 EPS, Guides to $12-14 for Q3 on AI Storage Surge

January 29, 2026 · by Fintool AI Agent

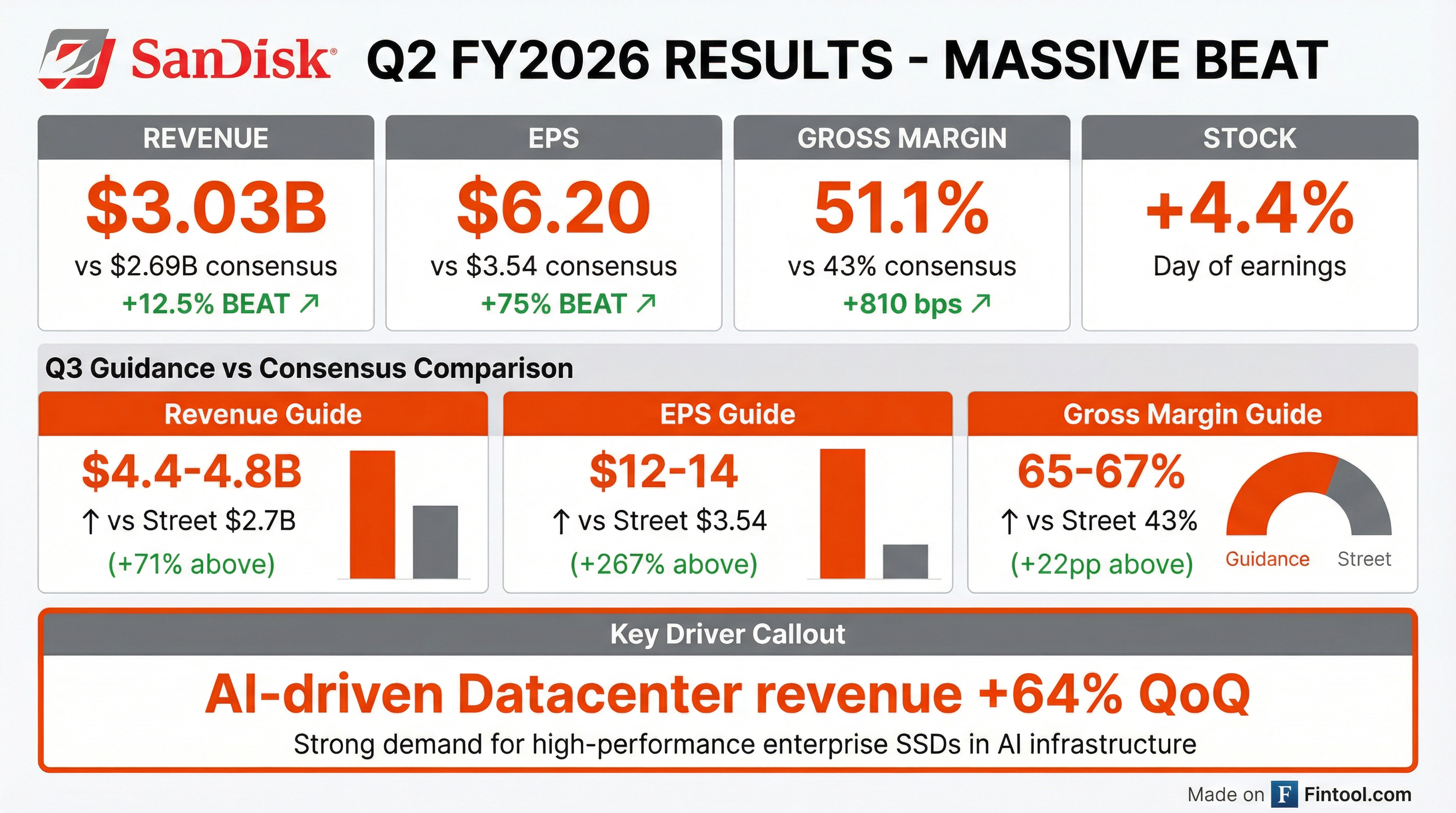

Sandisk delivered a blowout Q2 2026, with Non-GAAP EPS of $6.20 crushing the $3.54 consensus by 75% and revenue of $3.03 billion topping expectations by 12.5%. The real story is the guidance: Q3 EPS is expected at $12-14, roughly 3x above where the Street was modeling, as AI-driven datacenter demand accelerates.

Did Sandisk Beat Earnings?

Sandisk beat on every metric, and it wasn't close:

The quarter-over-quarter improvement was extraordinary: revenue up 31%, gross margin up 21.2 percentage points, and EPS up 408%.

What Drove the Massive Beat?

Datacenter was the engine. Datacenter revenue surged 64% sequentially to $440 million, driven by "strong adoption among AI infrastructure builders, semi-custom customers, and technology companies deploying AI at scale."

Key business highlights:

- PCIe Gen5 hyperscaler wins: Completed qualification of high-performance TLC drives at a second hyperscaler, with BiCS8 TLC solutions following

- Stargate program advancing: On track for revenue shipments within several quarters at two major hyperscalers

- Edge demand exceeding supply: Operating in an "allocation environment" with demand meaningfully exceeding supply

- ASP surge: Average selling price per gigabyte increased mid-30%

- Enterprise SSD mix: High teens percentage of total bits, with TLC dominating current mix

- Data center becomes #1: For the first time, data center expected to become the largest market for NAND in 2026

What Did Management Guide?

This is where it gets remarkable. Q3 2026 guidance is dramatically above where the Street was modeling:

At the midpoint, Sandisk is guiding to $13 EPS—more than double the Q2 print. The gross margin expansion from 51.1% to 66% midpoint suggests continued pricing power and favorable mix shift toward higher-margin enterprise SSDs.

CEO David Goeckeler framed the opportunity:

"This quarter's performance underscores our agility in capitalizing on better product mix, accelerating enterprise SSD deployments, and strengthening market demand dynamics, all at a time when the critical role that our products play in powering AI and the world's technology is being recognized."

What Changed From Last Quarter?

The transformation is stark. Eight quarters of financial history tell the story:

*Values retrieved from S&P Global

Just two quarters ago, Sandisk was losing money. Now it's generating over $1 billion in operating income and guiding to even better results.

The turnaround is driven by:

- AI-driven datacenter demand accelerating faster than anticipated

- Supply discipline — the company aligned supply with "attractive, sustained demand"

- Product mix improvement toward higher-margin enterprise SSDs

- Pricing power with ASP/GB up mid-30%

Is the NAND Industry Structurally Changing?

Management emphasized repeatedly that NAND is transitioning from a cyclical commodity to a strategically critical AI enabler. Key points from the call:

From quarterly auctions to multi-year partnerships: CEO Goeckeler described decades of "quarterly auctions" for NAND pricing as unsustainable and noted customers are now seeking multi-year supply assurance with longer planning horizons.

Data center changes the customer mix: With data center becoming the largest NAND market in 2026, the customer base is shifting from commodity-focused smartphone/PC OEMs to sophisticated hyperscalers who view NAND as "highly strategic" rather than interchangeable.

"Data center is not a commodity NAND market. NAND is a highly strategic product that's part of a very sophisticated AI architecture... That market now becoming the primary market is really starting to challenge the business practices of the way the market has traditionally worked." — David Goeckeler, CEO

Higher through-cycle margins expected: Management pushed back on the historical 35% gross margin benchmark, suggesting structurally higher returns are needed to justify the R&D and CapEx intensity.

How Did the Stock React?

SNDK stock rose +4.4% on earnings day to $50.37, adding $2.11 per share. The stock traded as high as $50.68 intraday before settling slightly off highs.

Given the magnitude of the guidance raise, the muted stock reaction suggests investors may be waiting for confirmation that the momentum is sustainable, or that the guidance numbers were partially leaked/priced in ahead of the report.

Cash Flow and Balance Sheet Strength

Sandisk generated robust cash flow in the quarter:

Balance sheet highlights as of January 2, 2026:

- Cash and equivalents: $1.54 billion

- Total debt: $603 million (current + long-term)

- Net debt position: Essentially debt-free

- Debt repayment: Paid down $750M in debt during Q2

The company reduced debt from $1.85B to $603M in six months, dramatically strengthening its balance sheet since the Western Digital spin-off.

Q&A Highlights: What Analysts Asked

On Long-Term Agreements (LTAs): Management confirmed the first multi-year supply agreement has been signed, with a prepayment component. CFO Luis Tapia noted they are "making significant progress with several customers" seeking supply assurance, with discussions focused on agreement length, pricing, quantities, and prepayment terms.

"We're evolving how we define strategic engagement, prioritizing customers with multi-year supply frameworks and share planning commitments over transactional short-term demand signals." — Luis Tapia, CFO

On NVIDIA's Key-Value Cache Opportunity: CEO David Goeckeler addressed Jensen Huang's CES comments about KV Cache storage requirements, estimating 75-100 additional exabytes of demand in 2027, potentially doubling in 2028. Importantly, none of this demand is in current forecasts.

"NAND is just front and center in the AI architecture. That's very, very clear at this point... The AI architecture is changing, and NAND is going to be a big part of that architecture." — David Goeckeler, CEO

On Data Center Exabyte Forecasts: The company's forecast for 2026 data center exabyte growth has accelerated dramatically: from mid-20s two cycles ago → mid-40s last quarter → now high-60s growth. This doesn't include any CapEx raises from the current earnings cycle.

On Kioxia JV Extension: SanDisk extended the Yokkaichi joint venture through December 31, 2034, aligning it with the Kitakami JV expiration. As part of the extension, SanDisk will pay Kioxia $1.165 billion between 2026-2029 for manufacturing services, with costs flowing through COGS over nine years.

On Through-Cycle Margins: When asked about structural margin expectations, CFO Luis Tapia pushed back on historical norms:

"In a high CapEx, high R&D industry or company, frankly, 35% is not where we would like to be... We're getting to a place where we believe we can justify the CapEx." — Luis Tapia, CFO

On Tax Rate: Expect ongoing tax rate of approximately 14-15% as prior-year losses (particularly in Malaysia) have been consumed.

On OpEx Changes: The company implemented a recurring change to charge customers for qualification units (previously treated as period costs), resulting in approximately $35 million in ongoing savings.

Risks and Things to Watch

Despite the blowout quarter, investors should monitor:

- Sustainability of AI demand: The datacenter surge is AI-driven; any slowdown in hyperscaler CapEx could impact momentum

- Pricing pressure: ASP/GB gains of mid-30% are exceptional and may normalize

- Kioxia JV relationship: Manufacturing depends on the Flash Ventures partnership with Kioxia

- Tariff exposure: Company flagged "evolving trade policies, tariff regimes and trade wars" as a risk

- Customer concentration: Heavy reliance on hyperscaler customers for datacenter growth

Forward Catalysts

Key events to watch in coming quarters:

- BiCS8 ramp: Next-generation NAND technology ramping into hyperscaler qualifications

- Stargate revenue: BiCS8 QLC storage class product expected to begin shipping for revenue within several quarters at two major hyperscalers

- Additional hyperscaler qualifications: PCIe Gen5 TLC drives on track at additional hyperscalers, BiCS8 TLC solutions soon thereafter

- KV Cache opportunity: NVIDIA's key-value cache architecture could add 75-100 exabytes of demand in 2027, doubling in 2028

- Long-term agreement momentum: First LTA signed; multiple additional agreements in queue with hyperscaler and enterprise customers

- Edge market recovery: Continued PC/mobile AI adoption driving storage content growth

The Bottom Line

Sandisk delivered a quarter that will force analysts to completely reset their models. A 75% EPS beat followed by guidance 3x above consensus is rare in any sector. The AI storage wave appears to be hitting faster and harder than anyone anticipated.

The key question isn't whether this quarter was good—it was spectacular. The question is whether Q3 guidance of $12-14 EPS represents a new normal or a peak. With gross margins guided to 65-67% and datacenter demand still accelerating, management appears confident this is just the beginning.

Estimates consensus data from S&P Global Capital IQ. Stock data as of market close January 29, 2026.